In today’s digital age, where online transactions have become the norm, ensuring the security of cardholder data is of paramount importance. The Payment Card Industry Data Security Standard (PCI DSS) was established to provide a comprehensive framework for protecting cardholder data and preventing fraud. To achieve PCI DSS compliance, organizations must meet a set of requirements designed to safeguard sensitive information. In this article, we will explore the 12 requirements of PCI DSS compliance, providing insights into each requirement and offering guidance on how businesses can fulfill them.

Contents

- 1 12 Requirements of PCI DSS Compliance

- 1.1 Requirement 1: Install and Maintain a Firewall Configuration

- 1.2 Requirement 2: Avoid Using Vendor-Supplied Defaults for Security Parameters

- 1.3 Requirement 3: Protect Stored Cardholder Data

- 1.4 Requirement 4: Encrypt Transmission of Cardholder’s Data

- 1.5 Requirement 5: Regularly Update Antivirus Software or Programs

- 1.6 Requirement 6: Develop and Maintain Secure Systems and Applications

- 1.7 Requirement 7: Restrict Access to Cardholder Data by Business Need to Know

- 1.8 Requirement 8: Identify and Authenticate Access to System Components

- 1.9 Requirement 9: Restrict Physical Access to Cardholder Data

- 1.10 Requirement 10: Implement Comprehensive Logging Mechanisms

- 1.11 Requirement 11: Regularly Test Security Systems and Processes

- 1.12 Requirement 12: Establish an Information Security Policy

- 2 Conclusion

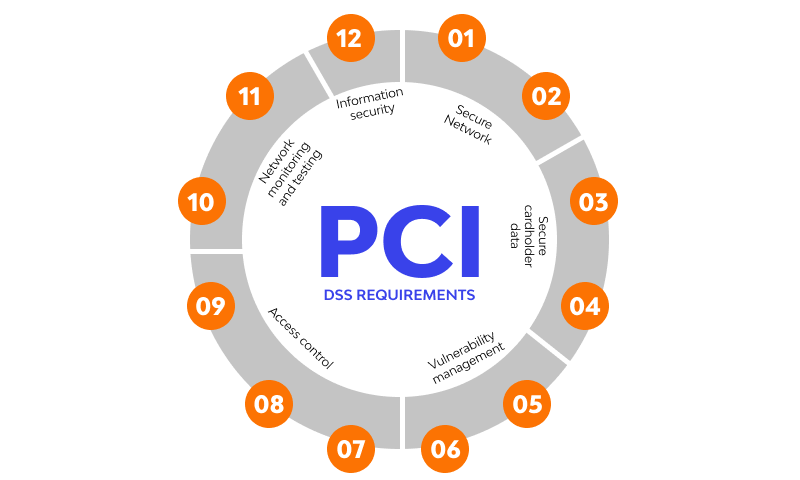

12 Requirements of PCI DSS Compliance

These are the 12 requirements of PCI DSS compliance:

Requirement 1: Install and Maintain a Firewall Configuration

To protect cardholder data from unauthorized access, businesses must establish and maintain a robust firewall configuration. Firewalls act as a barrier between internal networks and external networks, filtering incoming and outgoing traffic. By implementing a firewall, organizations can control access to their systems and prevent malicious entities from infiltrating their network.

To meet this requirement, businesses should regularly review and update their firewall rules to ensure they align with industry best practices. It is crucial to document firewall configurations and conduct periodic audits to identify and address any vulnerabilities or misconfigurations.

Requirement 2: Avoid Using Vendor-Supplied Defaults for Security Parameters

Using default passwords and security settings poses a significant risk to the security of cardholder data. Hackers are well aware of default credentials, making it easier for them to gain unauthorized access to systems. Therefore, it is essential to change default passwords and configure security parameters based on unique requirements.

Businesses should implement strong password policies, requiring employees to choose complex passwords and change them regularly. Additionally, multifactor authentication (MFA) should be enforced to add an extra layer of security.

Requirement 3: Protect Stored Cardholder Data

The protection of stored cardholder data is critical to prevent unauthorized access or theft. Businesses must implement encryption or tokenization methods to render the data unreadable to unauthorized individuals. Encryption ensures that even if data is compromised, it remains useless without the corresponding decryption keys.

Implementing strong encryption algorithms and secure key management practices is vital. Businesses should also implement strict access controls, allowing only authorized personnel to access stored cardholder data.

Requirement 4: Encrypt Transmission of Cardholder’s Data

When cardholder data is transmitted over open, public networks, it is susceptible to interception by malicious actors. To mitigate this risk, businesses must encrypt all sensitive information during transmission. Encryption scrambles the data, making it unintelligible to unauthorized individuals.

Secure protocols such as Transport Layer Security (TLS) or Secure Sockets Layer (SSL) should be used to establish secure connections between systems. This ensures that cardholder data remains protected while in transit.

Requirement 5: Regularly Update Antivirus Software or Programs

Malware can compromise the security and integrity of systems, leading to unauthorized access and data breaches. To safeguard against malware attacks, businesses must implement robust antivirus software and keep it up to date. Regularly updating antivirus programs ensures protection against the latest known threats.

Additionally, organizations should establish strict policies regarding the installation of software and the opening of email attachments or links. Employee education and awareness play a vital role in preventing malware infections.

Requirement 6: Develop and Maintain Secure Systems and Applications

Secure systems and applications are essential to protect cardholder data from vulnerabilities and exploits. Businesses must implement secure coding practices during the development phase and regularly update and patch their systems to address any discovered vulnerabilities.

Conducting vulnerability scans and penetration testing helps identify weaknesses in systems and applications. Prompt remediation of identified vulnerabilities is crucial to maintaining a secure environment.

Requirement 7: Restrict Access to Cardholder Data by Business Need to Know

Access to cardholder data should be limited to authorized individuals who have a legitimate business need to access the information. Implementing access controls ensures that only those individuals who require the data can access it.

Businesses should establish and enforce access control policies, granting user privileges based on job responsibilities. Regular access reviews and monitoring activities help identify any unauthorized access attempts or suspicious activities.

Requirement 8: Identify and Authenticate Access to System Components

Proper identification and authentication, measures are crucial for ensuring the integrity of systems and protecting cardholder data. Businesses must implement strong authentication mechanisms to verify the identity of individuals accessing system components.

This requirement includes the use of unique usernames and passwords, as well as additional authentication factors such as biometrics, tokens, or smart cards. By employing multi-factor authentication (MFA), businesses can significantly enhance the security of their systems and prevent unauthorized access.

Requirement 9: Restrict Physical Access to Cardholder Data

Physical security is equally important in maintaining PCI DSS compliance. Businesses must restrict physical access to areas where cardholder data is stored or processed. This includes implementing access control systems, surveillance cameras, and alarms to safeguard sensitive areas.

Proper employee identification badges, visitor controls, and clear desk policies are essential to prevent unauthorized individuals from gaining physical access to cardholder data. Regular monitoring and audits of physical security measures help ensure compliance.

Requirement 10: Implement Comprehensive Logging Mechanisms

Continuous monitoring of network resources and cardholder data is essential to detect and respond to potential security incidents promptly. Businesses must implement comprehensive logging mechanisms to track user activities, system events, and access to cardholder data.

By reviewing logs regularly, organizations can identify any suspicious activities, detect unauthorized access attempts, and investigate potential security breaches. Log data should be retained for an appropriate period as per legal and regulatory requirements.

Requirement 11: Regularly Test Security Systems and Processes

Regular security testing and assessments are crucial for evaluating the effectiveness of security systems and processes. Businesses must conduct vulnerability scans, penetration testing, and other security assessments to identify and address vulnerabilities or weaknesses.

These tests help organizations proactively identify and mitigate potential risks, ensuring the ongoing security of cardholder data. Regular testing provides insights into the overall security posture and enables the implementation of necessary improvements.

Requirement 12: Establish an Information Security Policy

To foster a culture of security, businesses must establish and communicate an information security policy. This policy should address all aspects of information security and provide clear guidelines and responsibilities for personnel.

To foster a culture of security, businesses must establish and communicate an information security policy. This policy should address all aspects of information security and provide clear guidelines and responsibilities for personnel.

The policy should cover areas such as password management, data classification, incident response procedures, and employee training. Regular security awareness training ensures that employees are aware of their roles and responsibilities in maintaining a secure environment.

Conclusion

PCI DSS compliance is a critical requirement for organizations that handle cardholder data. By adhering to the 12 requirements outlined in this article, businesses can significantly enhance the security of their systems, protect sensitive information, and build trust with their customers.

Remember, achieving compliance is an ongoing process that requires continuous monitoring, regular assessments, and prompt remediation of identified vulnerabilities. By prioritizing security and following best practices, businesses can mitigate the risk of data breaches and ensure the long-term security of cardholder data.

If you are looking to implement any of the Infosec compliance frameworks such as SOC 2 compliance, HIPAA, ISO 27001, and GDPR compliance, Impanix can help. Book a Free consultation call with our experts or email us at [email protected] for inquiries.

Read Related Blogs