In today’s dynamic and unpredictable business landscape, organizations face numerous uncertainties that can impact their operations and objectives. To navigate these uncertainties effectively, businesses need a robust Risk Management Framework (RMF) in place. This article will explore the concept of risk management, and its importance, and provide a comprehensive guide to implementing an effective risk management framework.

Contents

What is Risk Management?

Risk management refers to the systematic process of identifying, assessing, and prioritizing risks that may hinder the achievement of organizational goals. It involves understanding potential threats, evaluating their potential impact, and developing strategies to mitigate or capitalize on them.

Effective risk management is crucial for organizations of all sizes and industries. By implementing a risk management framework, businesses can proactively identify and address potential risks, minimize losses, optimize opportunities, and improve decision-making. It helps organizations protect their reputation, enhance stakeholder confidence, and achieve long-term sustainability.

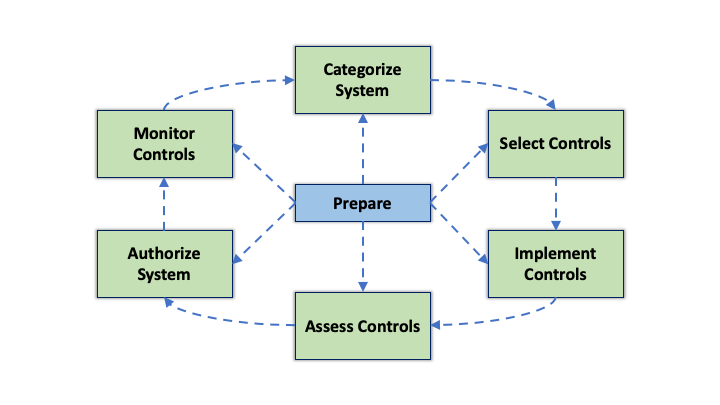

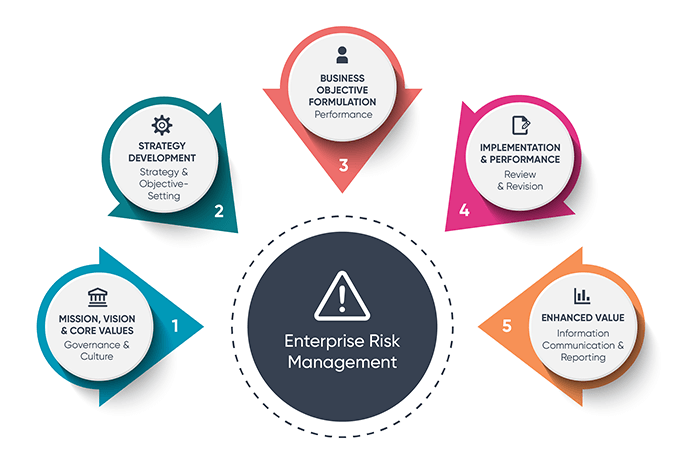

Components of a Risk Management Framework

A comprehensive risk management framework comprises several key components. These include establishing the context, identifying risks, analyzing risks, evaluating risks, treating risks, and monitoring and reviewing the effectiveness of risk mitigation strategies.

Step 1: Establishing the Context

The first step in building a risk management framework is to establish the context. This involves defining the organization’s objectives, identifying stakeholders, setting risk criteria, and determining the scope and boundaries of the risk management process.

Step 2: Identifying Risks

Once the context is established, the next step is to identify risks. This involves systematically identifying internal and external risks that could impact the organization’s objectives. Risk identification techniques such as brainstorming, SWOT analysis, and scenario planning can be utilized to identify potential risks comprehensively.

Step 3: Analyzing Risks

After identifying risks, the next step is to analyze them. Risk analysis involves assessing the likelihood and potential impact of each identified risk. Various qualitative and quantitative risk analysis techniques can be employed, such as risk probability and impact assessment, fault tree analysis, and Monte Carlo simulation.

Step 4: Evaluating Risks

Once risks are analyzed, they need to be evaluated to determine their significance. This involves comparing the identified risks against predefined risk criteria to prioritize them based on their potential impact and likelihood of occurrence.

Step 5: Treating Risks

After evaluating risks, the organization needs to develop and implement risk treatment strategies. Risk treatment options include risk avoidance, risk transfer, risk mitigation, and risk acceptance. The chosen strategies should align with the organization’s risk appetite and the cost-benefit analysis of each option.

Step 6: Monitoring and Reviewing

The final step in the risk management framework is monitoring and reviewing the effectiveness of the implemented risk mitigation strategies. This involves regular tracking of risks, evaluating the success of risk treatments, and making necessary adjustments to the risk management process.

Benefits of Implementing a Risk Management Framework

Some of the key advantages are:

- Enhanced Decision-Making: A robust risk management framework provides decision-makers with comprehensive information about potential risks. This enables them to make informed decisions, allocate resources effectively, and prioritize risk mitigation efforts.

- Proactive Risk Identification: By implementing a systematic risk management process, organizations can proactively identify risks before they escalate into significant issues. This allows for timely action and minimizes the impact of potential threats.

- Improved Resource Allocation: Risk management helps organizations allocate resources strategically. By understanding the risks associated with different initiatives, businesses can optimize their resource allocation, ensuring that resources are directed to areas with the highest risk exposure or potential returns.

- Stakeholder Confidence: Stakeholders, including investors, customers, and employees, have greater confidence in organizations that demonstrate effective risk management practices. A strong risk management framework enhances transparency, accountability, and trust, which are vital for maintaining positive relationships with stakeholders.

- Competitive Advantage: Organizations that successfully manage risks gain a competitive edge in the market. They are better equipped to handle uncertainties, adapt to changing circumstances, and seize opportunities that their competitors may overlook. This resilience and agility contribute to long-term success.

- Regulatory Compliance: Many industries are subject to stringent regulatory requirements. Implementing a risk management framework helps organizations comply with relevant regulations and avoid penalties or legal consequences. It ensures that risks related to compliance are identified and appropriately addressed.

- Cost Reduction: Effective risk management can lead to cost savings. By identifying and mitigating risks early on, organizations can prevent costly incidents, such as litigation, regulatory fines, or operational disruptions.

- Organizational Resilience: A well-designed risk management framework enhances an organization’s ability to withstand and recover from adverse events. It fosters a culture of resilience, where employees are prepared to handle unexpected challenges and adapt to changing circumstances.

Challenges in Risk Management

Implementing a risk management framework is not without its challenges. Organizations may face the following hurdles:

- Lack of Risk Awareness: Some employees may not fully understand the concept of risk management or the importance of their role in the process. It is crucial to raise risk awareness and provide adequate training and education throughout the organization.

- Inadequate Resources: Effective risk management requires dedicated resources, including personnel, technology, and financial support. Limited resources can impede the implementation and maintenance of a robust risk management framework.

- Uncertainty and Complexity: Risks are inherently uncertain and complex. It can be challenging to accurately assess and predict the probability and impact of certain risks. It is particularly those arising from emerging technologies or evolving market conditions.

- Resistance to Change: Introducing a risk management framework may face resistance from employees who are resistant to change or perceive risk management as an additional burden. It is essential to communicate the benefits and create a culture that values risk management.

- Integration Challenges: Integrating risk management processes with existing organizational structures and systems can be challenging. Ensuring seamless coordination between different departments and functions is crucial for an effective risk management framework.

Despite these challenges, organizations that successfully overcome them can reap the rewards of a well-implemented risk management framework.

Future Trends in Risk Management

- Advanced Analytics and AI: The use of advanced analytics and artificial intelligence (AI) is expected to play a significant role in risk management. These technologies can help organizations identify patterns, detect emerging risks, and automate risk monitoring and response processes.

- ESG Risk Management: Environmental, Social, and Governance (ESG) risks are gaining prominence in the business landscape. Organizations are expected to incorporate ESG considerations into their risk management frameworks to address issues such as climate change, social impact, and ethical practices.

- Integration of Risk and Performance Management: The integration of risk management with performance management processes is expected to become more prevalent. Organizations will strive to align risk management objectives with strategic goals and measure the effectiveness of risk management efforts in achieving desired outcomes.

- Supply Chain Resilience: The COVID-19 pandemic highlighted the vulnerabilities in global supply chains. Risk management frameworks will increasingly focus on enhancing supply chain resilience, including diversifying suppliers, developing contingency plans, and leveraging technology for real-time visibility and risk assessment.

Conclusion

In conclusion, a robust risk management framework is essential for organizations to navigate uncertainties, protect their interests, and seize opportunities. By implementing a comprehensive risk management process, organizations can proactively identify, assess, and mitigate risks, leading to better decision-making, enhanced stakeholder confidence, and long-term sustainability. While challenges exist, adopting best practices and staying abreast of emerging trends can help organizations build effective risk management frameworks and position themselves for success in an ever-evolving business landscape.

If you are looking to implement any of the Infosec compliance frameworks such as SOC 2 compliance, HIPAA, ISO 27001, and GDPR compliance, Impanix can help. Book a Free consultation call with our experts or email us at [email protected] for inquiries.